rsu tax rate us

Heres the tax summary for RSUs. A big note here you must enter a value even if the value is 0.

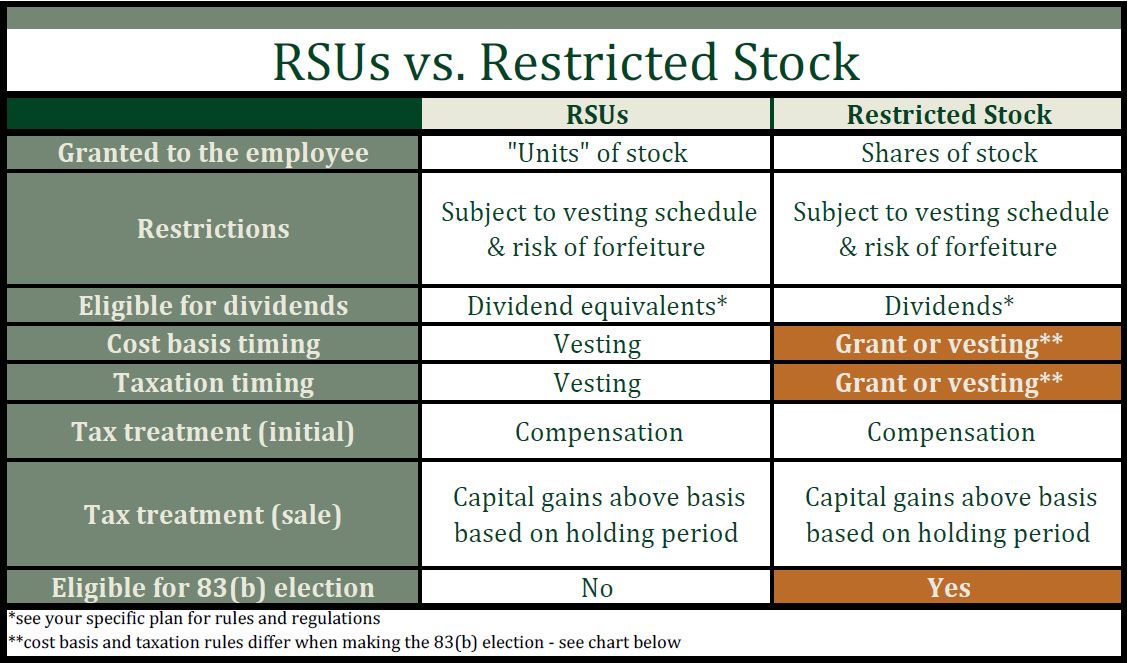

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

How your stock grant is delivered to you and whether or not it is vested are the key factors.

. Restricted Stock Units better known as RSUs are an increasingly popular form of incentivisation offered to employees. The capital gains tax rate when you sell the shares you own. Step 4 - Edit State Tax Rate Assumption.

RSU Tax Rate vs. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. These are a kind of employee share option scheme and are most commonly being offered by multinational tech companies but are also offered by some banks and other smaller companies albeit sometimes under a different name.

Restricted stock units RSUs and stock grants are often used by companies to reward their employees with an investment in the company rather than with cash. An RSU or a proportion of an RSU is liable to income tax under the PAYE system and is also a income tax in a State with which there is a double taxation agreement. Now that you know the basics of how RSUs work you can now confidently use the RSU Tax Calculator Below.

On this page is a Restricted Stock Unit Projection calculator or RSU calculator. Since RSUs amount to a form of compensation they become part of your taxable income and because RSU income is considered supplemental income the withholding rate can vary from 22 to 37. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

Ryan McInnis founded Picnic Tax after working for more than a decade at some of the financial services industrys leading firms. Taxes are usually withheld on income from RSUs. RSUs can trigger capital gains tax but only if the stock holder chooses to not sell the stock and it increases in value before the stock holder sells it in the future.

Restricted Stock Units RSUs Tax Calculator. Short-term capital gains tax ordinary income tax rates otherwise this includes immediate sale. Find out how restricted stock and restricted stock units RSUs which are forms of executive compensation work and how to deal with the tax consequences of them.

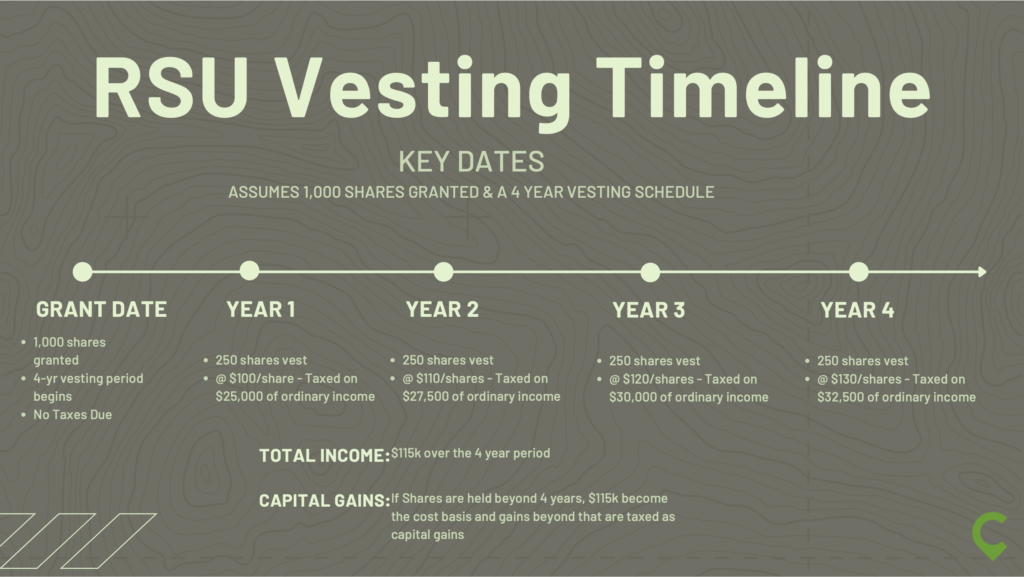

Ordinary tax on current share value. Stock grants often carry restrictions as well. The stock price at vesting in year one is 20 1000 x 20 20000 of ordinary income at year two 25 25000 at year three 30 30000 and at year four 33 33000.

This income will be reported in box 1 of your Form W-2 and is subject to ordinary income tax. When they vest ETrade applies a tax rate of 50 and sells shares to cover the tax to withhold. Unlike the much more complicated ESPP they get taxed the same way as your income.

In some states such as California the total tax withholding on your RSU is around 40. RSU Tax Rate. So its up to you to enter a percentage.

8 rows RSU income is tax ed when your shares vest. The ordinary earned income tax rate when the RSUs vest or. Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy Guide.

On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. Income from your RSU compensation is also subject to applicable state and local taxes. If you live in a high-income tax state like California where the highest income tax rate is 133 your tax due on your RSU income could be as high as 50.

This is true whether were talking about. This 7500 income from RSU vesting is called supplemental wages by the IRS. RSUs Restricted Stock Units are a big part.

From there the RSU projection tool will model the total economic value of your grant over the years. RSUs are taxed as W-2 income subject to federal and employment tax Social Security and Medicare and any state and local tax. Picnics goal is to make tax filing simpler and painless for everyday Americans.

The IRS and your state and local tax authorities if applicable view this 7500 as compensation income. As the name implies RSUs have rules as to when they can be sold. The value of over 1 million will be taxed at 37.

Assuming the stock price increased to 250 per share on 122020 you must pay income taxes on the RSU income of 7500 30250. Long-term capital gains tax on gain if held for 1 year past vesting. Here is the information you need to know prior to jumping in.

Your employer will typically withhold taxes at the. Its important to remember that the RSU tax rate will be the same as your income tax rates. The agentpayroll operator isthesatisfied that foreign income tax applies and has established the effective tax rates on the doubly taxed amount.

For your state tax rate itd be a little much for us to pull each states income tax and include it. Most companies will withhold federal income taxes at a flat rate of 22. RSU Taxes Explained.

I work in Germany US based company has one unit in Germany and get RSU awards into an account in US Etrade. The total is 108000 and each increment is taxable on its vesting date as compensation income when the shares. You receive 4000 RSUs that vest at a rate of 25 a year and the market price at grant is 18.

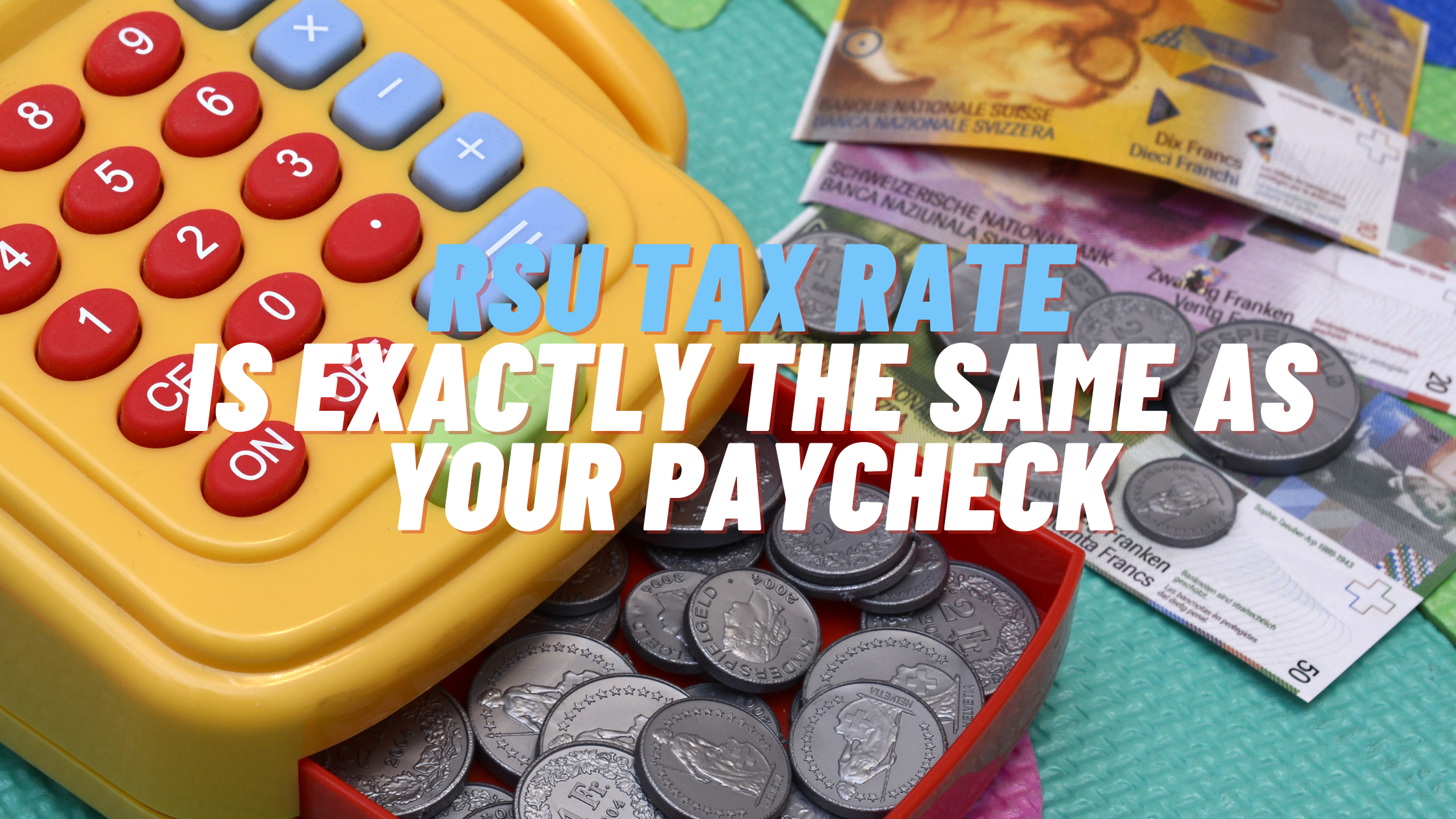

Tax Implications of Restricted Stock Units. RSU Withholding Rate A Common Confusion. The beauty of RSUs is in the simplicity of the way they get taxed.

RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. This doesnt include state income Social Security or Medicare tax withholding. Enter details of your most recent RSU grant your companys vesting schedule and some assumptions about your tax rate and your employers future returns.

At any rate RSUs are seen as supplemental income. This rate is 238 20 plus the 38 tax on net investment income for high-earning taxpayers. Generally there is no tax upon the sale of shares if the shareholder together with their fiscal partner has an interest less than 5 percent in the nominal subscribed share capital determined per class of shares.

In other words if the stock increase in value after youve paid ordinary income tax.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Restricted Stock Units Rsus Comprehensive Guide Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Restricted Stock Units How Rsus Affect Your Clients Taxes Tax Pro Center Intuit

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Units Jane Financial

A Tech Employee S Guide To Rsus Cordant Wealth Partners

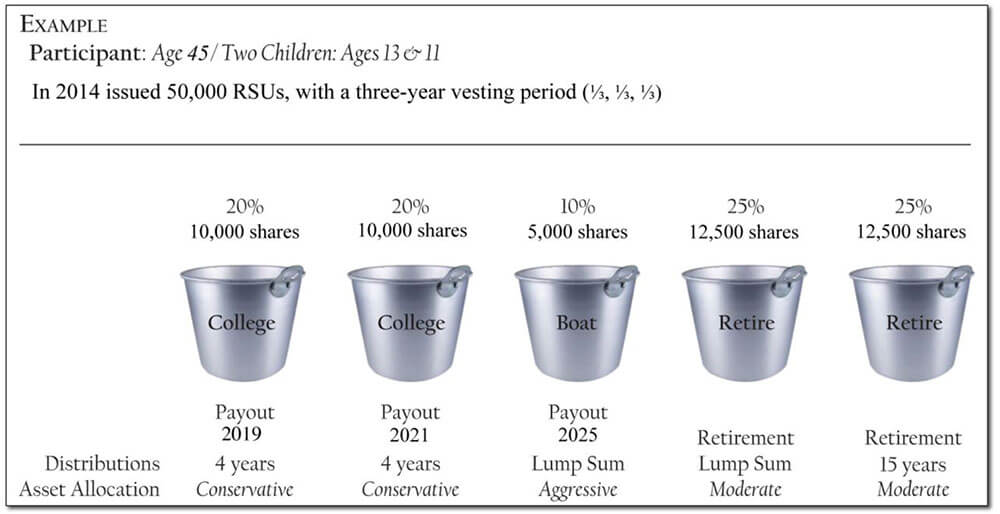

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsu Tax Rate Is Exactly The Same As Your Paycheck

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc